vermont sales tax food

Counties and cities can charge an additional local sales tax of up to 71 for a maximum possible combined sales tax of 10. Phone numbers for the Sales Tax division of the Comptroller of Public Accounts are as follows.

The Most And Least Tax Friendly Us States

This page discusses various sales tax exemptions in Minnesota.

. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. While the Minnesota sales tax of 6875 applies to most transactions there are certain items that may be exempt from taxation. Vermont SaaS is non-taxable in Vermont as of July 1 2015.

512 463-4120 Toll-Free Phone. Prescription Drugs are exempt from the Arkansas sales tax. Colorado has 560 special sales tax jurisdictions with local sales taxes in.

What transactions are generally subject to sales tax in Indiana. Cities and counties may add up to 4875 in additional sales tax. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

In Texas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Groceries are fully taxable at local rates. Sales Tax Exemptions in Oklahoma.

Several examples of exemptions to the. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. New York has a statewide sales tax rate of 4 which has been in place since 1965.

The Pennsylvania sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the PA state sales tax. Some examples of items that exempt from Pennsylvania sales tax are foodnot ready to eat food most types of clothing textbooks gum candy heating fuels intended for residential property or. Municipal governments in New York are also allowed to collect a local-option sales tax that ranges from 3 to 4875 across the state with an average local tax of 4254 for a total of 8254 when combined with the state sales tax.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. The maximum local tax rate allowed by New York law is. In the state of Pennsylvania sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Oklahoma has a lower state sales tax than 885. In Oklahoma certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825.

Sales Tax Exemptions in Florida. Must contain at least 4 different symbols. ASCII characters only characters found on a standard US keyboard.

Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and. Keeping you informed on how to handle buying selling renting or just nesting at home as we adapt to life during COVID-19. This page discusses various sales tax exemptions in Oklahoma.

If you are interested in the sales tax on vehicle sales see the car sales tax page instead. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12. While the Oklahoma sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. Sales Tax Exemptions in Minnesota.

Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the. In Florida certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. These items fall into three categories candy soft drinks and dietary supplements.

Before sharing sensitive information make sure youre on a state government site. Texas has 2176 special sales tax jurisdictions with local. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate.

The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. Groceries bought under the Supplemental Nutrition Assistance Program SNAP often referred to as food stamps arent subject to state sales tax. In Minnesota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Certain groceries any prosthetic or orthopedic. 40 food prescription and over-the-counter drugs exempt. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

The gov means its official. State government websites often end in gov or mil. Utah has a higher state sales tax than 538 of.

Scroll to view the full table and click any category for more details. Like SaaS sales tax can also be tricky especially when youre trying to figure out when and where your services are liable to sales tax. The PA sales tax applicable to the sale of.

Tennessee grocery items and ingredients are taxable but taxed at a reduced state rate of 4. This page discusses various sales tax exemptions in Florida. Some examples of exceptions to the sales tax are.

Food and Beverage. Local jurisdictions may add an additional 1. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Some examples of items which the state. While the Texas sales tax of 625 applies to most transactions there are certain items that may be exempt from taxation. Items that are taxable in Indiana include all tangible products.

Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. In addition some grocery items are taxable. While the Florida sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. This page discusses various sales tax exemptions in Texas. An example of an item which is exempt from Texas sales tax.

Sales Tax Exemptions in Texas. Groceries and prescription drugs are exempt from the Colorado sales tax. South Carolina Unprepared food that can be purchased with federal food stamps is exempt from state sales and use tax but may be subject to other local sales and use taxes.

While groceries are exempt from sales tax prepared foods are taxable. This page discusses various sales tax exemptions in Arizona. This table shows the taxability of various goods and services in Oklahoma.

6 medical items groceries clothing prescription and over-the-counter drugs are exempt. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. You can learn more by visiting the sales tax information website at wwwwindowstatetxus.

The Texas Sales Tax is administered by the Texas Comptroller of Public Accounts. All states except Illinois exempt prescription drugs from sales tax and Illinois taxes them at just 1 percent compared with 625 percent for its statewide sales tax. Sales Tax Exemptions in Arizona.

6 to 30 characters long. While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Wellness Springfield Food Co Op

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Digesting The Complicated Topic Of Food Tax Article

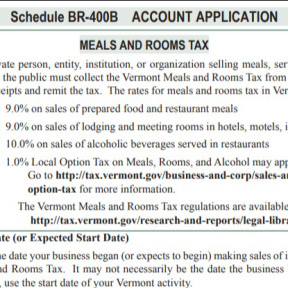

Sales And Use Tax Department Of Taxes

Everything You Need To Know About Restaurant Taxes

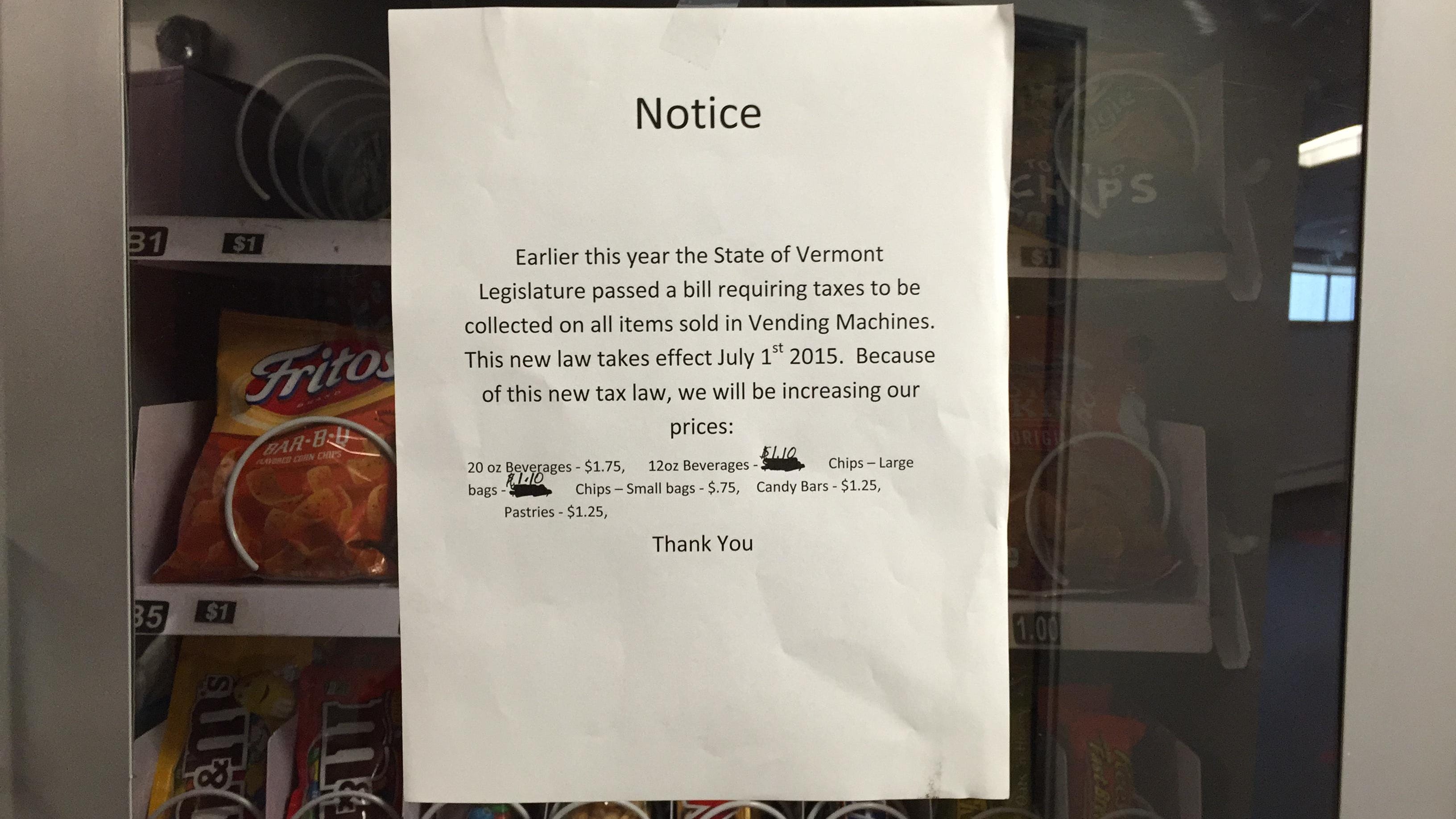

New Vermont Taxes Hit Snack Time

Is Vermont Really So Expensive Vermont Public

Sales Taxes In The United States Wikipedia

Vermont Sales Tax Small Business Guide Truic

What Is Sales Tax A Complete Guide Taxjar

New York Sales Tax Basics For Restaurants Bars

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

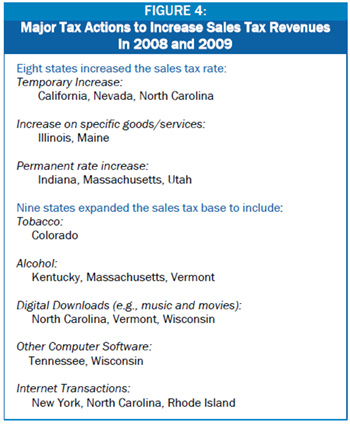

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Stowe Vermont 1960 Postcard Lodge Smugglers Notch Buffet Swordfish Ice Sculpture Ebay